Active Equity

An active mindset, aiming to deliver long-term outcomes

Overview

Equity investing can provide an opportunity to share in the profits and growth of companies. We invest with an active mindset, believing that opportunities can always be uncovered through collaboration and insight. What’s more, as part of our purpose to create a better future through responsible investing, we collectively engage with companies and governments through LGIM’s unified fixed income, equity and investment stewardship teams to strive for better outcomes, both for investors and our rapidly changing world.

Active equity at LGIM

Our edge in active investing lies in our conviction that collaborative teams of experts can deliver better outcomes for investors by focusing on alpha generation. Discover more about what makes us different below.

Fundamental Research

Every investment decision is informed by rigorous analysis and a long-term focus. Our understanding of the key strengths of the business, risks, opportunities, and financials helps shape our investment view of companies and sectors. This involves bringing together knowledge across the asset classes within LGIM as part of our research engagement framework.

Sustainable businesses

We believe long-term ownership of companies which are building the future of our economy, and which can grow throughout economic cycles, is essential to achieving long-term wealth creation. Fundamentally, we are looking for sustainable companies that can create attractive long-term benefits for all stakeholders and which are either misunderstood or mispriced by investors.

Long-term themes

We look to build a connected understanding of the world by formulating views on the secular and structural trends shaping the future. Specifically focusing on those key trends which are accelerating and have addressable markets.

For more on our investment process, read our Active Strategies outlook.

Responsible investing

We believe that responsible investing can strengthen long-term returns, through mitigating risks and unearthing investment opportunities.

At the heart of our investment approach is our cross-asset class research platform – the Global Research & Engagement Groups (GREGs) – which brings together teams of LGIM’s equity, fixed income and investment stewardship experts. These GREGs focus on identifying opportunities for potential future gains, as well as avoiding the risks that threaten the sustainability of future returns, all while engaging with companies for positive change.

In line with our purpose to create a better future through responsible investing, all of our active equity strategies aim to benefit from LGIM’s broader ESG integration and active engagement.

Joined-up approach to research and engagement

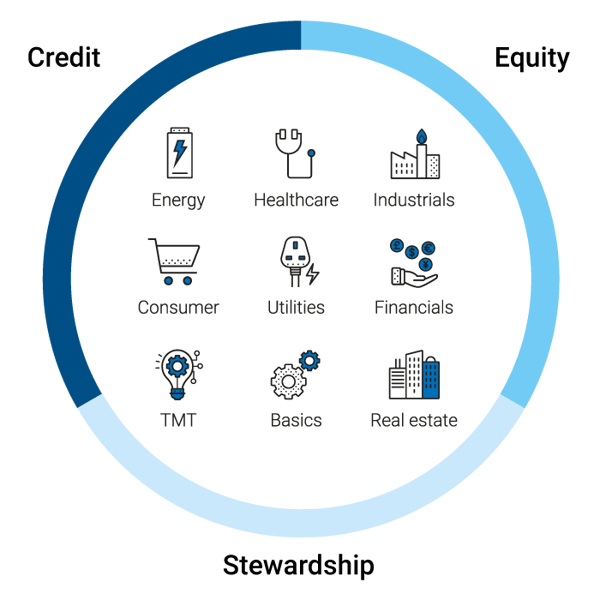

Cross-asset expertise is at the core of our approach

70+ experts organised into nine sector groups

- Cross asset-class research platform that combines the expertise of credit, equity and investment stewardship

- Three-dimensional lens to analyse and capture both fundamentals as well as ESG-related or ‘not-yet financial’ risks

- Maximising our engagement efforts though a joined-up, collective stakeholder approach

Key literature & Fund centre

Insights

Our latest thought leadership articles, fund and market commentaries, blog posts, videos and upcoming LGIM events.

Recommended content for you

Get in touch

Get in touch

If you would like any further information please complete the contact us form.

Key risks

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Past performance is no guarantee of future results.

Whilst LGIM has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within funds that do not include specific ESG goals within their objectives.

The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing in this fund is available in the prospectus at. http://www.lgim.com/fundcentre