US election: themes and implications

We take stock of the upcoming US election, focusing on the potential implications for investors across a range of asset classes

Many of the themes at the heart of the US election, and other political developments elsewhere in the world, are of immense importance to investors.

Since our last update, investors have gained some clarity on monetary policy, with major developed market central banks kicking off easing cycles. But the outcome of the US election, another key macro driver, has become much more uncertain.

The presidential race was upended during a few weeks of extraordinary political drama, in which Kamala Harris replaced Joe Biden as the Democratic candidate, dashing expectations of a Republican victory. The current vice president will now face off against Donald Trump, the former president, in the vote on 5 November.

Markets – at least at a headline index level – seem relatively relaxed about the race. We think that may change as the candidates enter the home stretch. The convulsions across the investment landscape of early August point to the underlying fragility in risk assets we noted earlier this year, especially because many valuations remain lofty.

That’s why this publication, to which teams across L&G’s Asset Management division have contributed, is focused on the implications for investors of the race to the White House, both near term and long term. We discuss:

- How different election outcomes might impact US assets

- Positioning for a ‘Harris trade’

- Four key questions over the impact of tariffs on inflation and growth

We also weigh how a number of key elections over the coming months might shape the investment landscape; the impact the US election could have on clean energy investment; and the potential challenges and opportunities within private markets posed by deglobalisation.

Market pricing

There are important parallels between this election and others that have taken place elsewhere around the world. For example, some of the topics dominating the campaign are very much part of the political discourse in Europe – including inequality and immigration, on which large numbers of voters appear to be expressing frustration. This helps to explain the rise of parties such as Alternative for Germany, Reform in the UK and Marine Le Pen’s National Rally in France.

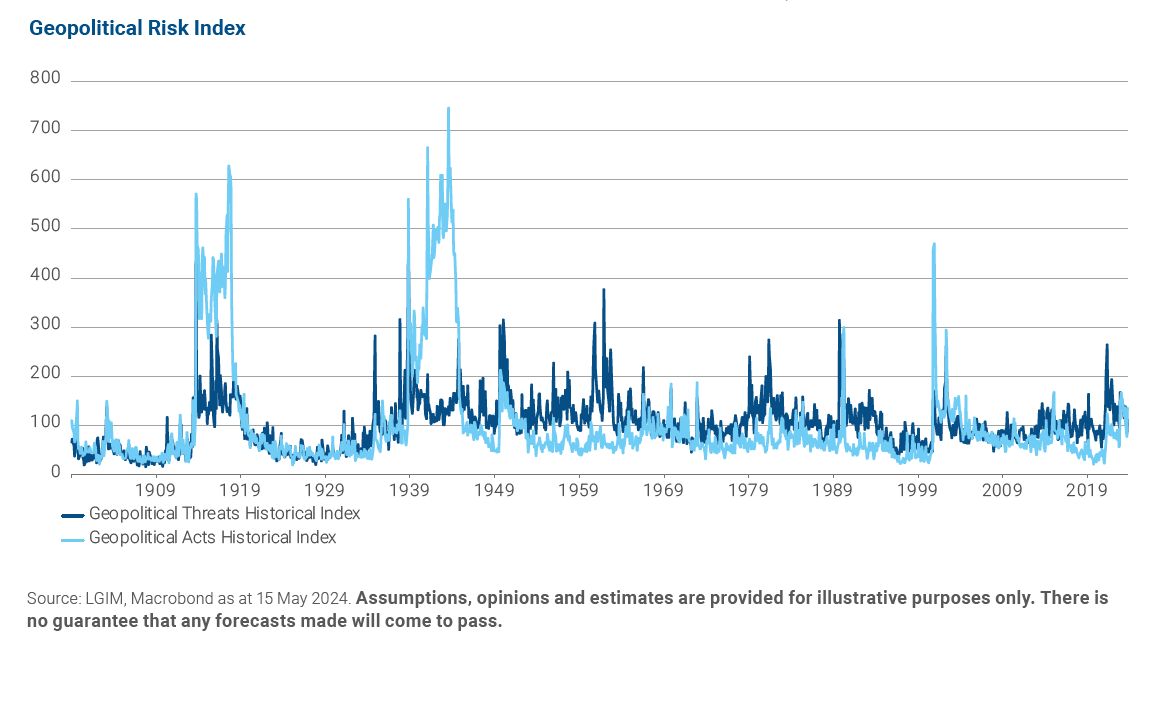

The broader backdrop is one of an increasingly multipolar world, unsettled by technological advances, demographic challenges and geopolitical strife. These underlying themes are of immense importance to investors.

As noted in our research, they impact the outlook for growth and inflation – and the attendant policy responses. Some of them, not least geopolitical tensions, are incredibly difficult to position around or hedge against.

This explains why markets do not appear to be pricing in the risks stemming from conflicts that are already under way, such as those in Ukraine and the Middle East. As a result, we believe it’s critical to conduct regular scenario analysis in order to think through potential implications. We also think this makes diversification* more important than ever, to help withstand a range of economic scenarios – and mitigate the impact of any single market event.

*It should be noted that diversification is no guarantee against a loss in a declining market.

Key risks

The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

Whilst we have incorporated ESG information into investment decision making and stewardship practices, there can be no assurance that any responsible investing goals will be met.

Author(s)