Q3 Active Fixed Income Outlook: Back to the 1970s?

Geopolitical tensions, sticky inflation and ballooning government deficits. Sound familiar? Could the prospect of 1970s stagflation be gaining traction? And if so, what are the possible implications for fixed income investors?

The below is an extract from our Q3 Active Fixed Income Outlook.

The myopic focus on the rate-cutting of the US Federal Reserve (Fed) and its ability to impact all asset classes ignores the multiple forces at work in today’s financial markets. Combined, these drivers have the potential to affect both the path of growth and inflation. The result is that any high-conviction views held over the soft-landing narrative should be treated with an extreme degree of caution, in our view. Our investment mantra, as ever, remains ‘prepare, don’t predict’.

A myriad of forces at work in financial markets

At face value, the forces themselves are easy enough to identify – the euphoria surrounding the growth of artificial intelligence (AI) and increased geopolitical tensions, not just in the Middle East, but in Russia/Ukraine and the South China Sea, are well documented. Global fiscal incontinence and the extent to which China can contribute to world economic growth are among the others.

We would argue that it is precisely because of the presence of these disruptive forces that investors are unable to accurately pinpoint where we are in the economic cycle. While no two economic cycles are the same, the ability to transpose asset allocation decisions onto a framework that points to an expansionary or recessionary phase has, for the most part, become null and void. Not having this framework deprives today’s market participant from using a key part of the investor toolkit.

So, are we in a late cycle acceleration phase, driven by the forces that have made the post-pandemic world so interesting and challenging to navigate? Or are we at the beginning of a new cycle, an AI-driven investment boom that will be largely unaffected by the current level of interest rates? Both possibilities have profoundly different asset allocation outcomes.

The return of stagflation?

We believe the most interesting parallels for today’s investor are to be found in the 1970s – an era characterised by high inflation and a cooling of economic growth. Back then, growth in US fiscal spending was prominent, fuelled by military costs related to the Vietnam War. The collapse of the Bretton Woods system in 1971 and the Arab-Israeli conflict of 1973 also contributed to further inflation and volatile growth.

While today’s inflation rate is nowhere near that of the 1970s, the stickiness of service inflation is a problem. As is the cooling of global GDP. Corporate earnings growth continues to be seen mostly among an elite group of technology stocks, while rich valuations indicate that investors remain uncomfortably optimistic in their outlook.

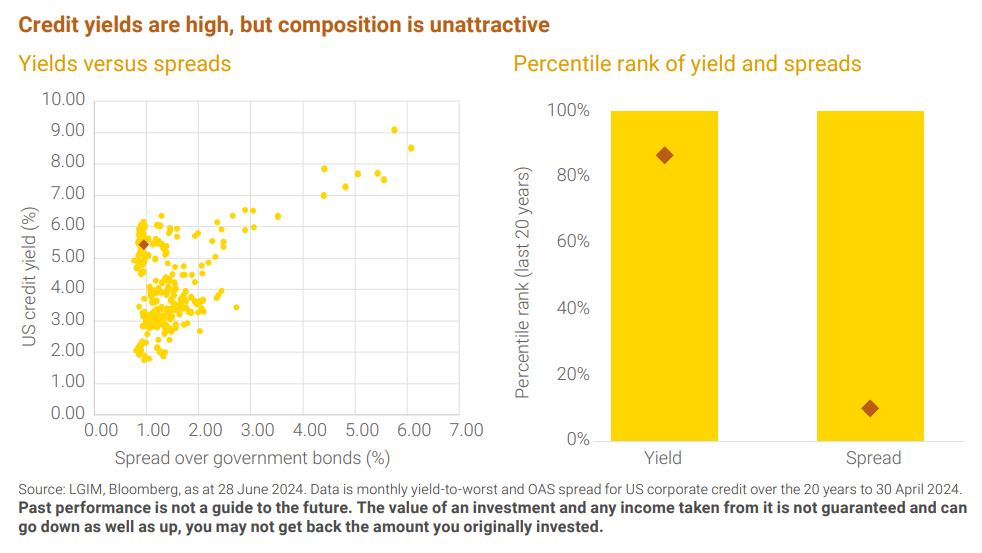

That level of optimism extends to the credit universe. While credit yields are high, their composition is unattractive, with spreads hovering near all-time tights. That scenario is fine if the US follows the path of a soft landing and perfect disinflation. If it continues to cool (we have seen tentative signs in new orders and US retail sales) then that could be problematic. How investors balance credit risk versus duration risk will, once again, be the key as we enter the second half of 2024.

Outlook

With valuations in credit and equities where they are, there's little room for manoeuvre if something goes wrong. All this comes against the backdrop of the impending US election and the possible return of Donald Trump to the White House. Should that happen, any questioning of the Fed’s independence will not be good for term premia.

While uncertainty will inevitably increase as we get closer to the political event with the greatest global significance, we believe there are still pockets of value. For example, we prefer hard currency emerging market debt to high yield and investment grade. Looking at the curve, the shorter end feels safer for now, which means taking less duration risk. But if the burden of rising fiscal deficits persists, it will pay to stay as flexible and nimble as possible with regards to duration.

The above is an extract from our Q3 Active Fixed Income Outlook.

Key risks

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Past performance is no guarantee of future results.

Whilst LGIM has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within funds that do not include specific ESG goals within their objectives.

The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing in this fund is available in the prospectus at. http://www.lgim.com/fundcentre