Consumer Duty

Discover how LGIM is responding to the new Consumer Duty

Consumer Duty is probably one of the most significant regulatory changes from the FCA in recent years. Building on previous regulations around 'Treating Customers Fairly' and 'Vulnerable Customers', the Duty is about how we do business with, and how we treat, our customers throughout their time with us.

LGIM has always had a dedicated focus on Customer Values and we have established through our review process that many of our existing procedures already adhere to the standards of the Duty. Ahead of its implementation, we added additional governance so that we can fully demonstrate the significance of the Duty in the way we conduct business on behalf of our clients.

What is the Consumer Duty?

The FCA’s Consumer Duty is designed to set higher and clearer standards of consumer protection across financial services and requires firms to put their customers’ needs first.

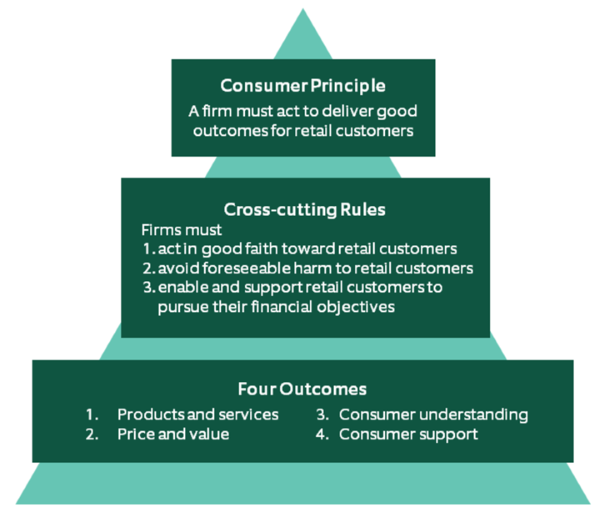

The Duty introduces a new principle, Principle 12: ‘a firm must act to deliver good outcomes for retail customers.’

This principle is supported by three Cross-cutting Rules and four customer outcomes.

What are the three Cross-cutting Rules?

What are the four consumer outcomes?

While LGIM already has well-established product governance and consumer-focused business arrangements, Consumer Duty gives us the opportunity to enhance our services across our offering.

LGIM is supporting you and your clients by addressing the four consumer outcomes in the following ways:

Outcome: All products and services for retail customers are fit for purpose, designed to meet consumers’ needs, characteristics and objectives, and distributed appropriately.

LGIM regularly reviews its fund ranges as part of its product lifecycle management activities, which is a robust governance framework designed to ensure our products and services continue to remain suitable for retail clients. Our product reviews are conducted across a number of qualitative and quantitative measures, and funds are also stress-tested from a scenario analysis perspective at launch, or at the point of material amendment.

Target market

LGIM is committed to ensuring our products and services meet the needs and requirements of the identified target market and as a distributor of our products and services, we commit to making that identified target market and relevant distribution strategy available to you.

To further support distributors with their Consumer Duty responsibilities, LGIM will be adopting the launch of the European MiFID template EMT 4.1 for both our UK and European domiciled funds.

This template has been designed to ensure additional, supporting information can be exchanged between product manufacturers and distributors with ease, so that you can access the information you need on our Product range, Including the Target Market for our UK domiciled funds. Our UK EMT 4.1 can be found here.

MPS

For our Model Portfolio Service, which is also in scope of the Consumer Duty, details of the target market and distribution strategy can be found here

Outcome: Consumers receive fair value (i.e. there is a reasonable relationship between the price paid and benefits received).

Assessment of Value

UK domiciled funds

It is our responsibility to ensure that our firm performs a detailed assessment to determine whether our funds provide value for money to retail investors. For our UK domiciled funds our assessments are carried out against seven factors: Quality of service; Fund performance; Authorised fund manager costs; Economies of scale; Comparable market rates; Comparable Services; and Unit classes.

Our full Assessment of Value Report for our UK domiciled funds can be found here.

MPS

As part of the FCA’s higher expectations regarding the consideration of the needs of the target market, we have further expanded this value assessment to include our Model Portfolio Service, the results of which can be found on our MPS website here:

European domiciled funds

Our European domiciled funds are not subject to UK regulation but are indirectly impacted in respect of the funds that are sold for UK wholesale and retail investment. UK distributors will therefore require certain information from us in order to evidence price and value outcomes. Therefore, where appropriate, a value assessment will also be conducted on our European domiciled funds sold within the UK market to retail clients. The EMT 4.1 for our European Domiciled funds can be found here and here

Outcome: To support and enable consumers to make informed decisions about financial products and services.

LGIM aims to ensure that retail-facing communications are clear and understandable. Communications will continue to be assessed and tested where appropriate and a new LGIM Business Standard has been embedded to enhance our commitment in ensuring our communications support understanding and good outcomes for retail customers.

Outcome: To provide a level of support that meets consumer’s needs throughout their relationship with the firm.

LGIM has undertaken retail customer journey mapping to ensure retail customers are provided with the customer support they need going forward. This also includes analysis to ensure the characteristics of customers are considered more broadly, including client vulnerability.

The Consumer Duty and LGIM

At LGIM we consider that many of the key principles of the Act are already embedded into our existing processes. We will continue to support good outcomes for our retail clients, and to enhance the processes we currently have in place, to make sure that the investment objectives of our products, services, and supporting materials comply with the Consumer Duty regulation.

Further information

You can find out more about the Consumer Duty itself on the FCA’s Consumer Duty page

Legal & General (Unit Trust Managers) Limited, as manufacturer of funds, gives notice to all distributors of its funds, of their respective information-sharing obligations under the Consumer Duty effective from 30 April 2023. Our message to all ‘Distributors’ under the Consumer Duty