The power behind clean power: energy transition metals

In the first of two blogs, we explore the role that metals will play in powering the transition to renewable energy.

Throughout humanity’s energy story, commodities have played a vital role. From the coal that propelled the industrial revolution to the oil boom in the second half of the 20th century, commodities have powered seismic shifts in how we live. As the world transitions from fossil fuels to renewable energy, a new cast of commodity characters will take centre stage.

Over two blogs we’ll examine two broad categories of commodities and policy tools central to the energy transition:

- Transition commodities: such as transition metals as critical inputs to produce, distribute and store clean energy

- Carbon pricing: a policy tool that discourages pollution and increases the competitiveness of renewables

Transition metals for energy generation and storage

Metals are the foundation of the energy transition, enabling the construction of vast wind turbines, connecting solar panels with distribution systems and storing power in electric vehicles (EVs).

The metals needed for the energy transition can be broken down into four categories:

- Critical metals: these are fundamental inputs to renewable power infrastructure. Examples include aluminium for its high strength-to-weight ratio and corrosion resistance, and copper for its high thermal and electrical conductivity

- Energy storage enablers: metals such as lithium, nickel and cobalt have a crucial role in battery cells. We covered this subject in depth in this whitepaper

- Supporting metals: iron, lead and tin are needed for the buildout of the electricity grid and associated infrastructure

- Specialist transition supporters: precious metals such as silver, gold and platinum have physical properties that make them vital inputs for renewable power systems

The energy transition is contributing to expectations of a significant increase in overall demand for metals. Between 2022 and 2030 metal demand is projected to see a compound annual growth rate of up to 40%,1 and a further 600% increase by 2050.2

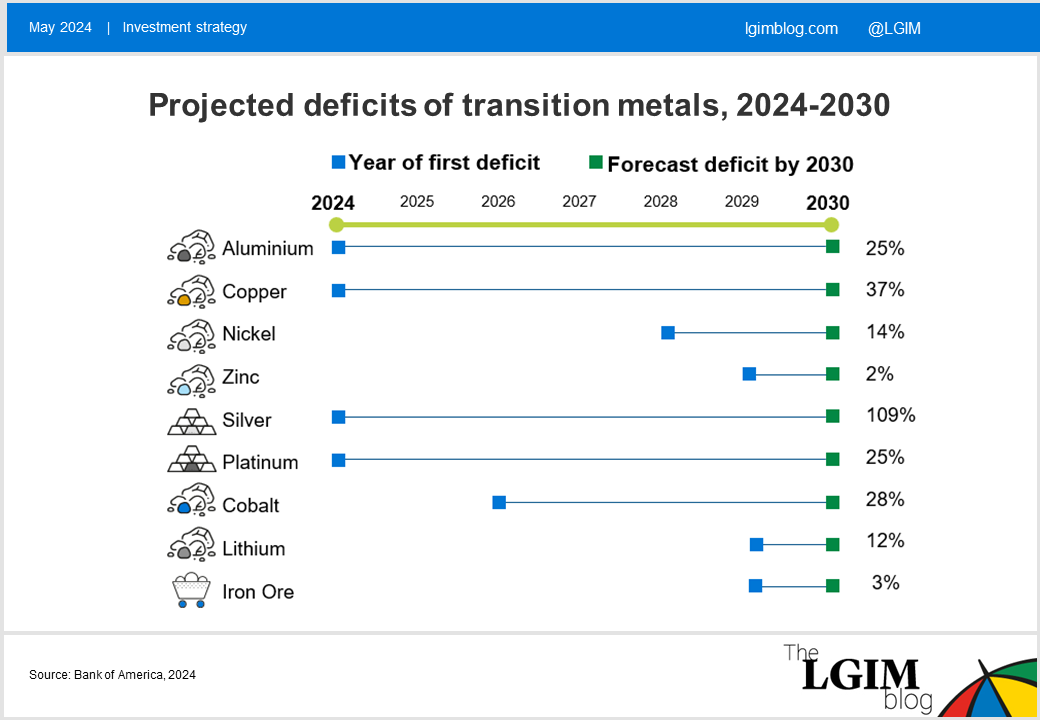

While the critical metals required for clean energy production, energy storage and EVs do exist at the fundamental level of resources, getting huge volumes of these metals out of the ground and through today’s supply chains to feed this demand though is not straightforward. As a result, deficits in availability are expected across a range of metals by the end of the decade, or are recorded today in some cases:

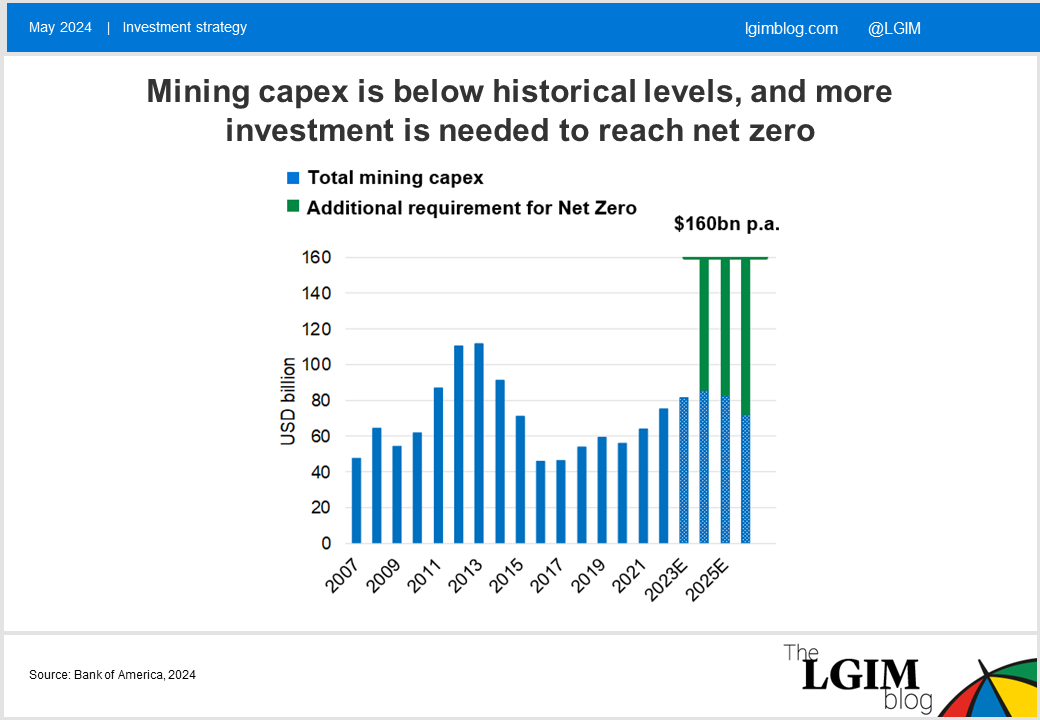

Despite these looming deficits of vital metals, capex remains well below the amount that would be required to reach net zero, as mining companies grapple with higher operating and labour costs and complex permitting journeys. These significant supply constraints further increase upward price pressure on these metals.

From a commodity standpoint, lower-carbon energy can also support the transition for the next few years, until the world can fully rely on clean power at times of peak energy demand. That said, metals remain the major commodity solution that will keep powering a net zero world.

Metal scarcity in supply chains is a clear challenge presented by the energy transition, but also a unique opportunity. The world’s transition from a fossil fuel-based economy to a clean energy enabled economy is built around new inputs that are not yet represented in commodity portfolios.

This suggests a potential opportunity for investors who, in line with this transition, may want to reduce exposure to traditional fossil fuel futures and capture transition metals that will power a decarbonised world.

In the next part of this blog, we’ll examine the role of carbon pricing as a policy tool in incentivising lower-carbon activities.

* For illustrative purposes only. Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security. Assumptions, opinions and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts made will come to pass.

1. Source: Bank of America, 2023.

2. Source: ibid.

Key risks

The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

Whilst we have incorporated ESG information into investment decision making and stewardship practices, there can be no assurance that any responsible investing goals will be met.

Author(s)

Elisa Piscopiello

Senior ETF Analyst