AA Outlook Q2 2024: Something's gotta give

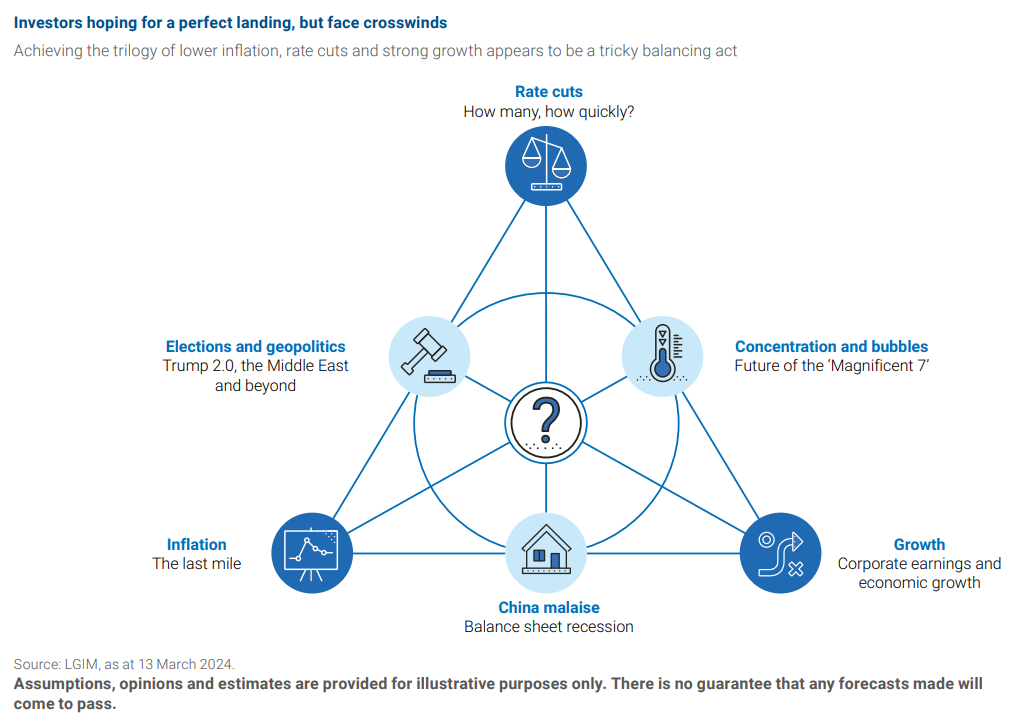

Consensus is clustered around a trilogy of lower inflation, rate cuts and continued growth. Is the market beginning to question this benign path?

The following is an extract from our Q2 Asset Allocation outlook.

The first quarter saw a strong rally in risk assets amid increasingly widespread optimism. Yet April hints the path to a soft landing has narrowed, and, at this altitude, investors risk being more exposed to a shift in the wind or a decline in visibility. This creates a potentially unforgiving environment for risk assets.

Since our last quarterly update US GDP expectations have gathered pace, with virtually all forecasters now giving up on recession. Despite the positive growth momentum, a gradual cooling is still widely expected, so consensus is now heavily clustered around a narrow soft-landing window. Inflation has surprised to the upside in the first three months of 2024, driven by sticky services prices.

This combination has led markets to pare rate cut expectations this year from six to no more than two. Yet this delay in rate cut expectations has not proved too problematic for equity markets, which despite some increase in volatility in April, partly due to heightened geopolitical risks, have taken the view that this is merely a bump in the road to rate cuts amid a higher neutral rate.

Another rabbit in the hat

The continued resilience of the US economy surprised many, ourselves included. As we’ve highlighted previously, fiscal policy has been highly supportive for growth, with Federal spending and deficits exceeding expectations, alongside robust state and local government spending. Excess household savings and the onshoring boom also played a part.

Developments in labour markets have recently emerged as another potential explanation, with recent Congressional Budget Office data showing US immigration has been much stronger than previously estimated. This is likely to be a hot-button topic ahead of the election, but from an economic viewpoint, it’s had the unintended consequence of allowing the labour market to rebalance alongside still strong employment growth. Job vacancies are being filled, but unemployment remains relatively stable.

Assessing the potential of AI

The strong performance of equity markets in the quarter has also been supported by continued optimism around artificial intelligence (AI).

Our team continues to assess the possible macro impacts of AI as we move rapidly from proof of concept to real-world solutions. There’s no doubt that a sudden spike in productivity would be disruptive, potentially eroding the negotiating power of labour, causing deflation, or even displacing whole groups in society whose skills cease to be valued.

And yet…

Despite the consensus optimism, we remain short risk assets.

We believe the combination of what’s priced in equity markets, credit valuations, rate cuts, top-down earnings, ‘Goldilocks’ growth and inflation expectations will prove difficult to achieve, and a deviation from this narrow path is most likely to negatively impact equities. Strong nominal US GDP growth and a rise in productivity growth have helped companies meet or beat earnings expectations, lifting markets. But if inflation is to fall back to target, this could put pressure on margins – a typical late-cycle development.

This also means the economy and markets are vulnerable to shocks, for instance the human tragedy and flare up of geopolitical risk we unfortunately see unfolding in the Middle East at the moment.

Outside the US, changes to growth and inflation outlooks have been more subtle as growth has continued to stagnate, though expectations remain for some recovery through the year. China remains a notable laggard, with the property overhang dragging on activity and prices, though some policy support is allowing the broader economy to muddle through for now.

The above is an extract from our Q2 Asset Allocation outlook.

Key risks

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Past performance is no guarantee of future results.

Whilst LGIM has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within funds that do not include specific ESG goals within their objectives.

The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing in this fund is available in the prospectus at. http://www.lgim.com/fundcentre