Alternative debt

Tailoring debt solutions to clients’ needs through a range of alternative investment types

Delivering wide-ranging strategies across alternative debt

Alternative debt covers a broad spectrum, from trade and asset-backed finance through to government supported transactions, derivatives strategies, private asset-backed securities (ABS) and debt-for-nature swaps. In this diverse asset class, we offer a pooled fund solution to investors in the form of our Short-Term Alternative Finance Fund, a fund which invests in sub one-year opportunities.

Growing demand for credit facilities from alternative investment funds and large corporates has meant banks can no longer service these alone. We have developed trusted relationships with global banks and other financial intermediaries to source what we believe to be attractive investment opportunities for our clients.

Case studies

Swap repackaging transactions

Swap repackaging transactions involve the transfer of inflation-linked derivatives exposures held by a bank to an institutional investor better suited to holding long-dated assets. They typically involve highly rated regulated utility companies with the credit exposure ranking in line with, or often senior to (super- senior), their highest-ranking debt.

Capital Call Facilities (CCFs)

CCFs are senior short-dated loans (typically <12 months) to private investment funds that are secured against their legally binding Limited Partners (LPs) commitments as well as any fund assets. This form of bridge financing helps private funds smooth their drawdown profile and boost their IRRs.

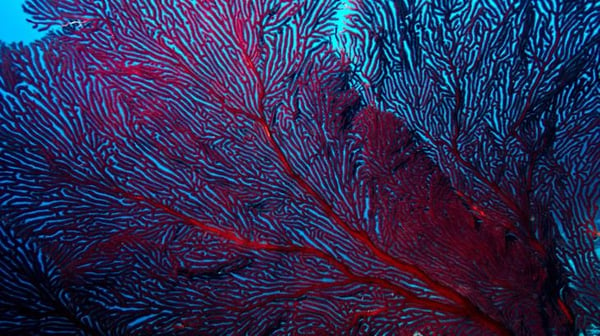

Belize – debt-for-nature deal

Belize is the first project where we committed to the issuing of a blue bond, supporting marine conservation. The aim is to significantly reduce the country’s debt service cost.

At the same time, a proportion of the proceeds and interest payments of the loan will go towards protecting Belize’s barrier reef – the second largest in the world and a UNESCO recognised world heritage site.

Belize source: LGIM as at November 2021

Other asset strategies

Corporate debt

For private corporate and public sector entities seeking to borrow outside of the public markets, we specialise in providing bespoke debt financing across a variety of sectors, structures and geographies.

Infrastructure debt

We provide debt financing across four key infrastructure sectors: energy, transportation, digital and social.

Real estate debt

Drawing on LGIM’s position as one of the UK’s largest and most experienced property investors, we provide expertise in senior loans secured against a broad range of property sectors.

Contact us

Get in touch

If you would like any further information please complete the contact us form.

Key risks

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Past performance is no guarantee of future results.

Whilst LGIM has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within funds that do not include specific ESG goals within their objectives.

The risks associated with each fund or investment strategy should be read and understood before making any investment decisions. Further information on the risks of investing in this fund is available in the prospectus at. http://www.lgim.com/fundcentre